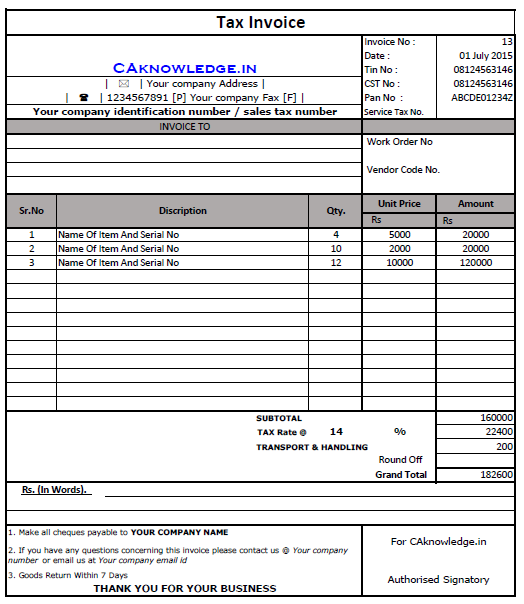

Tally Sales Invoice Format In Excel Download Free

Goods & Services Tax will impact accounting and invoicing processes across industries for both Chartered Accountants and Businesses. After July 1, businesses and accountants will have to adopt software and ERPs which are capable of managing taxation, invoicing & accounting as per the new tax regime.

- Download our free invoice templates for Word or Excel. Choose between five free invoice template designs and start sending invoices today.

- Eazy AUTO4.0 provides a simple and easiest automated way to post your data from Excel to Tally. This utility is developed by Impression Systems.Now you can run Tally4.5 in Windows Xp, Vista or even in Windows7 using AUTO4.0 without using virtual machine.

May be reproduced, translated, revised, stored in, or introduced into a retrieval system, or transmitted in any form, by any means. 2.1 Taxable Purchases and Sales. 2.1.1 Purchase of Taxable Goods. Example 1: On 2-4-2012, National Traders purchased the following items from Excel Traders vide invoice number 01.

Cleartax being a pioneer in the industry will help you understand the technical aspects of the implementation of Goods and Services Tax, the impact on ERP systems, and what you need to do to be tax compliant in this section. From 1st July, 2017 Goods and Services Tax will replace Central and State level indirect taxes like VAT, Service tax, Excise etc. Businesses that are registered under VAT or Service Tax need to migrate to Goods & Services tax as per the enrolment plan of State Governments. It is applicable to you if your annual turnover is Rs.

20 lakh or above. In case of North Eastern states (Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, and Tripura) and hilly regions i.e. Himachal Pradesh, Uttarakhand, Jammu & Kashmir and Sikkim, the threshold limit is Rs. Read our articles to understand more about registration process, its applicability and rules.

All existing Central Excise and Service Tax assessees and VAT dealers will be migrated to GST. To migrate to the new tax system, assessees would be provided a Provisional ID and Password by CBEC/State Commercial Tax Departments.

Learn more about the process. All businesses plan your transition into the new Goods & Services Tax regime with our guides available here and make a smooth transition. Find out how you can carry forward your input tax credit from existing tax regime to GST.

Read all about the transition provisions in our articles. A return is a document that a taxpayer is required to file as per the law with the tax administrative authorities. Under the Goods & Services Tax law, a normal taxpayer will be required to furnish three returns monthly and one annual return. Similarly, there are separate returns for a taxpayer registered under the composition scheme, taxpayer registered as an Input Service Distributor, a person liable to deduct or collect the tax (TDS/TCS). Use our expert guides to understand how to file various returns under Goods and Services Tax for your business. GST Compliance Rating is a numerical rating given to businesses depending on their level of compliance with Goods & Services Tax rules. Refund claims under the GST regime will also be processed on merit basis, i.e on the GST compliance rating of the registered taxpayer.

It is expected that certain slab rates will be maintained for various taxpayers falling under various bandwidths of compliance rating and the refunds will be made in terms of percentage amount based on the individual rating of the taxpayer. Higher compliance ratings will make the refunds process easier for businesses. The Harmonized Commodity Description and Coding System generally referred to as “Harmonized System of Nomenclature” or simply “HSN” is a multipurpose international product nomenclature developed by the World Customs Organization. It comprises about 5,000 commodity groups; each identified by a six digit code, arranged in a legal and logical structure and is supported by well-defined rules to achieve uniform classification. Without HSN, the system will not be able to pick tax rate for goods declared at the time of registration. ClearTax GST with its powerful billing, vendor data mismatch reconciliation mechanism, validation engines and return filing process serves as a single platform for all GST compliance. You can create 100% GST complaint bills or bulk import sales and purchase data from your accounting software such as Tally in excel format.

Free Invoice Format In Excel

It data validation engine ensures that you are notified when your data looks not in line with set rules, reducing chances of errors. You can also collaborate with your accountant and other colleagues in real time. Data security is top priority at ClearTax as a tax company. We have taken all industry safety measures to make sure, that your data remains safe both while in transit as well as when at our platforms:. ClearTax encrypts sensitive data using industry-leading methods.

Even when data is transmitted over public networks, we make sure that it flows in encrypted form. We use standard, well-reviewed cryptographic protocols and message formats (such as SSL and PGP) when transferring data. We ensure that cryptographic keys are at least 128 bits long (AES). Asymmetric keys must be at least 2048 bits long (RSA). We also install security updates and patches on our servers and equipment on a regular basis.

Tally Sales Invoice Format In Excel Download Free Windows 10

The Security settings of applications and devices are tuned to ensure appropriate levels of protection as well. If you are using any version of tally(licenced or cracked) you can continue using Tally for your accounting needs whereas for GST compliance such as uploading invoices to GST, filing returns etc, you can use ClearTax GST.You can import the data through two routes:. Manual: Export all your sales data and purchase data into excel files from tally. Go to GST returns filing feature of Cleartax GST and click on import.

Browse your excel file and import all the data into Clear Tax GST. Automatic 2 way data integration using connectors: Very soon we will offer API enabled integration between all versions of Tally and Cleartax GST software.

You need to just download the API Utility. Once implemented,it will be reflected under Utilities as ClearTax integration. The connectors will allow 2-way data integration between Tally and ClearTax GST software, i.e you will be able to push data to ClearTAX gst platform from Tally at a click and import the data back to Tally from ClearTax platform. You can bulk import all your sales and purchase data into ClearTax GST platform through two ways. Import data using Cleartax standard template. Import data using a customised template Templates are excel formats designed to capture your sales and purchase data.

You can download ClearTax Standard template and fill out all the sales details in the format and upload it Or You can upload your original excel sheet and then map all the column headings to heading scheme followed by ClearTax. Once data is imported you can view all the invoices at a glance. The software will automatically process the data and prepare GST returns for you. ClearTax GST will soon be working online as well as offline. Which means you will be able to use the software even when you are not connected with internet.

Once you get online, the data will automatically sync up. I have multiple team members across different departments who need to access the sales and purchase transactions data? Do I need to take special subscription for multi-user access? No, you can add as many users as you want for your business account. Also, you can manage the access rights granted to each user.

. The pro forma invoice template is mostly used when you wish to send a final bill copy to a client for an order placed.

The prior stages to pro forma invoice will include communication with your clients regarding the sample process. Once an order is confirmed by a client, then it requires you to send them a detailed bill copy along with the product details and quality, terms of payment and the details of delivery. This can be best done with the help of a pro forma invoice template.

In case you are in the architecture business and wish to send quotation or final billing details to your client then it is really important for you to have a contractor invoice template. The template allows you to enter details such as invoice number and the date of invoice, detailed description regarding your client, along with the kind of work that will be performed.

There is separate column to indicate the amount of labor, material cost and furnish other details before adding them up to the final cost. The invoice format can be easily downloaded in PDF format and put to use at ease.

Voicing your Needs 1. Many of these templates are specifically designed to help small and medium-sized businesses which cannot always have a full-fledged invoice system. These templates can be used to create very professional invoices with minimal cost and effort. Many of these invoice template are free and easily available online for download. Different file formats can be used to generate invoices, whether in, Word, Open Office, PDF, HTML or other such formats. Therefore businesses with different needs can equally make use of them. Updating of information, reminders to users about previously due invoices and other such aspects of database and record-keeping can help one track one’s payments and receipts.

Some of the templates are based on user feedback and the problems that arise in using generic templates can be ironed out and improved with the help of these features. All told, printable invoice formats are a major asset to businesses. Invoices form an important role in any business. The success and failure of a business is hugely dependant on the technique by which business invoices are maintained. The above invoice formats are easy to use and effectively serve its intended purpose to a business concern.

The invoice templates are available in various formats such as PDF, word or even in excel format. Such kind of easy downloadable template helps users to concentrate on other tasks than working on a format of billing.